Table of contents

Table of contents

⚖️ Disclaimer: This guide is for general informational purposes only and does not constitute legal or tax advice. Nonprofit classifications, requirements, and restrictions vary based on an organization’s activities and funding sources. Always consult the IRS or a qualified attorney or tax professional before choosing or changing your nonprofit status.

When people hear “nonprofit,” they usually think of 501(c)(3) organizations—well-known public charities and foundations like the American Red Cross, YMCA, PETA, or the Bill & Melinda Gates Foundation. But in reality, “nonprofit” is a much broader umbrella. The IRS recognizes more than 30 different types of nonprofits, each with its own rules, benefits, and limitations.

That’s where confusion often sets in. Which nonprofit types can fundraise? Which allow advocacy or membership dues? Which make donations tax-deductible for supporters?

In this guide, we’ll break down 30+ IRS-recognized nonprofit organization types and explain how they differ in practice. No matter your cause, you’ll leave with a clearer understanding of which classification best fits your mission and goals.

Key takeaways

- Charity, foundation, and nonprofit are not the same ❓ Each has different rules around funding, governance, and what donors can deduct.

- More than just 501(c)(3) 🌍 The IRS recognizes 30+ nonprofit categories, each with different rules around fundraising, advocacy, and tax-deductible donations.

- Find your match 🎯 The right nonprofit type depends on how you plan to raise money, who you serve, and whether you’ll advocate, fundraise, or collect dues.

- Choose the correct classification 🧠 When your mission and IRS status align, compliance is simpler, and fundraising is more sustainable.

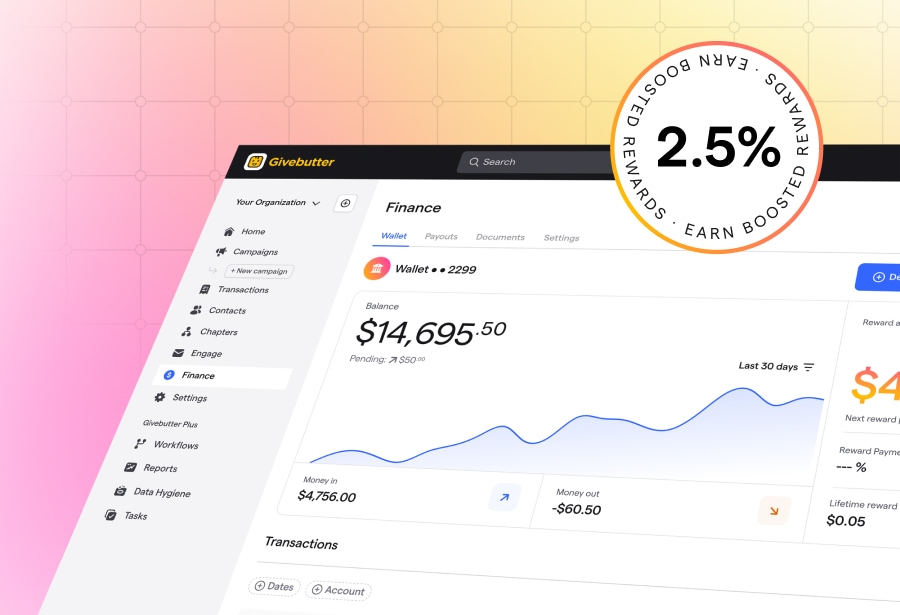

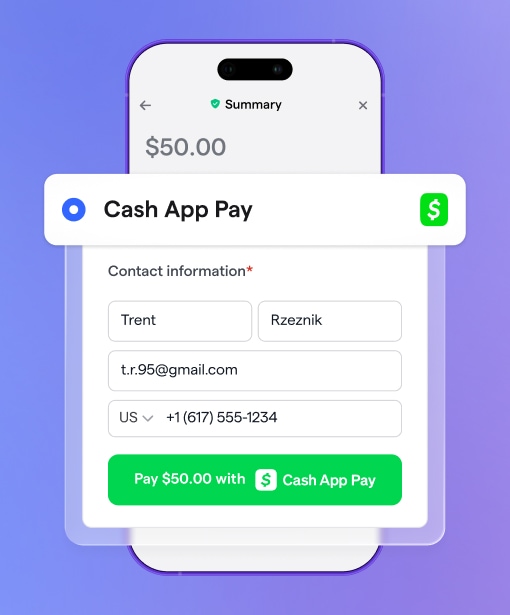

- Built for every nonprofit type 🧈 Whether you’re collecting donations, running events, managing memberships, or engaging supporters, Givebutter gives every nonprofit the tools to grow—no matter how the IRS classifies your organization.

Common IRS-recognized nonprofit types (at a glance)

The Internal Revenue Service (IRS) recognizes more than 30 nonprofit classifications. Some of these aren’t relevant to many nonprofit founders, as they exist for highly specialized, regulated, or industry-specific uses.

Below is a reference list of the different types of IRS-recognized nonprofit organizations, with examples. We’ll explore each in more detail later in this guide and help you identify which ones actually apply to your goals.

Charitable, religious, & public-benefit organizations

- 501(c)(3): Charitable organizations serving public-benefit purposes

- 501(d): Religious and apostolic associations

- 501(e): Cooperative hospital service organizations

- 501(f): Cooperative service organizations of operating educational organizations

- 501(k): Childcare organizations

- 501(n): Charitable risk pools

Advocacy, social welfare, & civic organizations

- 501(c)(4): Civic leagues and social welfare organizations

- 501(c)(19): Veterans’ organizations

Membership, labor, & trade organizations

- 501(c)(5): Labor, agricultural, and horticultural organizations

- 501(c)(6): Business leagues, chambers of commerce, and trade associations

- 501(c)(7): Social and recreational clubs

- 501(c)(8): Fraternal beneficiary societies

- 501(c)(10): Domestic fraternal societies

Financial, insurance, & employee-benefit organizations

- 501(c)(9): Voluntary employees’ beneficiary associations (VEBAs)

- 501(c)(11): Teachers’ retirement fund associations

- 501(c)(12): Benevolent life insurance associations and mutual utilities

- 501(c)(14): State-chartered credit unions and mutual reserve funds

- 501(c)(15): Mutual insurance companies or associations

- 501(c)(21): Black lung benefit trusts

- 501(c)(22): Withdrawal liability payment funds

- 501(c)(26): State-sponsored high-risk health coverage organizations

- 501(c)(27): State-sponsored workers’ compensation reinsurance organizations

- 501(c)(29): Qualified nonprofit health insurance issuers

Property-holding, cooperatives, & special-purpose organizations

- 501(c)(1): Corporations organized under an Act of Congress

- 501(c)(2): Title-holding corporations for exempt organizations

- 501(c)(13): Cemetery companies

- 501(c)(16): Cooperative organizations to finance crop operations

- 501(c)(17): Supplemental unemployment benefit trusts

- 501(c)(18): Employee-funded pension trusts (created before June 25, 1959)

- 501(c)(25): Title-holding corporations or trusts with multiple parents

- 501(c)(28): National Railroad Retirement Investment Trust

- 521(a): Farmers’ cooperative associations

- Section 527: Political organizations and committees

💡 Don’t worry if this list feels like a lot. Most founders consider only one or two categories seriously.

Charity vs. nonprofit vs. foundation: What’s the difference?

You may have heard the terms charity and nonprofit organization used interchangeably. You might also be wondering about the differences between a foundation vs. a nonprofit. In reality, there are many types of nonprofits, and charities and foundations are just two of them.

Here’s a quick overview of these different types of nonprofits and how they operate:

- Charity 💚 Most commonly operating as 501(c)(3) public charities, these nonprofits serve the public good (such as education, relief, or animal welfare) and are eligible to receive tax-deductible donations.

- Foundation 💸 This type of 501(c)(3) organization is defined by how it’s funded, often by a single family, individual, or company. Foundations typically make grants to other nonprofits, though some run their own charitable programs.

- Nonprofit 🏛️ A broad umbrella term for any organization that exists to serve a mission rather than generate profit, nonprofits include charities, advocacy groups, trade associations, and other tax-exempt entities.

In other words, all charities and foundations are nonprofits, but not all nonprofits are charities.

Types of nonprofit organizations recognized by the IRS

Each nonprofit is classified by its purpose, how it operates, and what it’s allowed to do. Below, we’ll explain the different kinds of nonprofits, with examples, as defined in IRS Publication 557.

501(c)(3) organizations: Charitable nonprofits

501(c)(3) organizations are the most common type of nonprofit in the United States. These nonprofits carry out charitable activities that serve the public good, such as education, science, or disaster relief.

Although these nonprofits are generally tax-exempt, some may still need to pay taxes in specific situations, such as for unrelated business income or certain state or local requirements. Donations made to this type of organization are typically tax-deductible.

Charities vs. foundations: How the IRS decides

Charities and foundations both exist to support a cause and are treated as tax-exempt organizations for tax purposes, but they differ in how they raise funds. Here’s a quick explainer on these two types of 501(c)(3) nonprofits:

- Public charities 💚 Supported by many donors, including individuals, companies, and grant-making organizations.

- Private foundations 💸 Receive financial support from one family, individual, or company.

The IRS uses the public support test to determine whether an organization qualifies as a charity or a foundation based on its funding sources. In practice, most nonprofits you encounter, or that you might establish, are public charities with a diverse range of funding.

Types of 501(c)(3) organizations

Under the 501(c)(3) classification, nonprofits are further grouped based on how they receive financial support:

- 509(a)(1): Broad public support

- 509(a)(2): Program or service revenue

- 509(a)(3): Supporting organizations

- Private foundations

The first three classifications apply to public charities, while the final category applies exclusively to private foundations.

Political activity for 501(c)(3)s

501(c)(3) nonprofit organizations are prohibited from engaging in political campaigns, both directly and indirectly. As a result, if a nonprofit gets involved with a political campaign, it could lose its tax-exempt status.

Organizations that focus primarily on advocacy or political activity fall under a different nonprofit category, which we’ll cover next.

501(c)(4) organizations: Social welfare & advocacy groups

Nonprofit organizations that act in social welfare and advocacy are classified as 501(c)(4) nonprofits. This group allows the organization to engage in some political campaign activity, but its primary purpose must remain the promotion of social welfare.

Permitted activities include:

- Lobbying for legislation

- Advocating for public issues

- Educating voters about the political process

✍️ Keep in mind: Organizations whose primary purpose is influencing elections are treated as political organizations under section 527, not as 501(c)(4) social welfare organizations.

Membership & trade organizations (dues-based nonprofits)

This type of nonprofit organization serves its members rather than the general public. Within this category, you’ll find membership organizations, business leagues, labor groups, and social clubs.

501(c)(5) organizations: Labor & agricultural groups

Labor and agricultural organizations are classified under 501(c)(5). Nonprofits of this type work to improve working conditions, wages, or benefits for their members.

🔎 Example organizations: American Nurses Association, Transport Workers Union of America, and American Farm Bureau Federation

501(c)(6) organizations: Business leagues & chambers of commerce

Chambers of commerce, business leagues, and similar professional groups are classified as 501(c)(6) nonprofits. These organizations aim to improve conditions within their industry or support the stability and growth of businesses more broadly.

🔎 Example organizations: U.S. Chamber of Commerce, American Marketing Association, and the Institute for Supply Management

501(c)(7) organizations: Social & recreational clubs

Nonprofits with a social or recreational purpose, such as local sports associations or community groups, fall under 501(c)(7). These organizations receive membership fees or dues and exist primarily for the pleasure and recreation of their members.

🔎 Example organizations: Country clubs, fraternities, sororities, hobby clubs, alumni associations, and community associations

Financial & employee-benefit nonprofits

This type of nonprofit organization is structured to manage money, insurance, or benefits for its members, rather than to raise funds from the general public.

501(c)(12), 501(c)(14), & 501(c)(15) organizations: Credit unions & mutual insurance associations

These nonprofits exist to provide insurance, loans, or funds at a reasonable cost to members and small communities. There are several classifications within this category:

- 501(c)(12): Benevolent life insurance associations

- 501(c)(14): State-chartered credit unions and mutual reserve funds

- 501(c)(15): Mutual insurance companies

501(c)(9) organizations: Voluntary employee beneficiary associations (VEBAs)

VEBAs are classified as 501(c)(9) organizations and exist to provide employees, and in some cases retirees, with benefits such as health, sickness, or accident coverage. A VEBA can be established by an employer or by an employee group, such as a labor union.

🔎 Example organizations: Wells Fargo & Company Employee Benefit Trust and AT&T Union Welfare Benefit Trust

Veterans, fraternal, & special-purpose nonprofits

Nonprofits in this section tend to have narrow, mission-specific purposes that are best served by more defined classifications. These organizations are often shaped by historical or eligibility requirements and may include fraternal societies, veterans’ groups, and organizations created for specific services such as retirement benefits or insurance.

Examples of these special-purpose nonprofits include:

- 501(c)(8): Fraternal beneficiary societies

- 501(c)(10): Domestic fraternal societies

- 501(c)(11): Teachers’ retirement fund associations

- 501(c)(13): Cemetery companies (not-for-profit organizations)

- 501(c)(16): Cooperative organizations to finance crop operations

- 501(c)(17): Supplemental unemployment benefit trusts

- 501(c)(18): Employee-funded pension trusts (created before June 25, 1959)

- 501(c)(19): Veterans’ organizations

- 501(c)(21): Black lung benefit trusts

- 501(c)(22): Withdrawal liability payment funds

- 501(c)(25): Title-holding corporations or trusts with multiple parents

- 501(c)(26): State-sponsored high-risk health coverage organizations

- 501(c)(27): State-sponsored workers’ compensation reinsurance organizations

- 501(c)(28): National Railroad Retirement Investment Trust

- 501(c)(29): Qualified nonprofit health insurance issuers

501(d) organizations: Religious & apostolic associations

501(d) nonprofit organizations are religious or apostolic community groups that operate a business. Revenue from that business is used to sustain and support members.

🔎 Example organizations: Farms, confectioners, and monasteries that produce and sell goods

501(e) organizations: Cooperative hospital service organizations

Organizations in this category, often referred to as CHSOs, exist to help nonprofit hospitals centralize resources and reduce operating costs. Acceptable services include data processing, purchasing, warehousing, and administrative support.

501(f) organizations: Cooperative service organizations of operating educational organizations

Cooperatives of this type pool money from their members at educational institutions, which is then invested on their behalf. Income and dividends from those investments are shared among participating members.

501(k) organizations: Childcare organizations

Some childcare organizations can qualify for nonprofit status and be tax-exempt by providing services that enable parents to become gainfully employed.

501(n) organizations: Charitable risk pools

Organizations can qualify for 501(c)(3) nonprofit status if their risk pool is organized for charitable purposes and meets specific IRS requirements, including a minimum of $1M in startup capital from non-charitable sources.

521(a) organizations: Farmers’ cooperative associations

Farmers’ cooperatives provide members with access to education, resources, and tools through shared services or expanded market access. Cooperatives that meet the requirements of section 521 may qualify for tax exemption.

527 organizations: Political organizations & committees

Nonprofits of this type fall under Section 527 of the Internal Revenue Code and are created to influence elections or public policy.

Many political committees and groups are treated as 527 organizations for tax purposes, though the term is often used more narrowly to refer to those outside standard campaign finance committee structures.

🔎 Example organizations: Republican Governors Association and Democratic Governors Association

How to choose the right type of nonprofit organization

Choosing the right group or charity category for your nonprofit is a crucial step in ensuring alignment with your mission and compliance with regulations. Your nonprofit classification also affects whether your organization is exempt from federal income tax, as well as governance requirements, including whether you’re required to form a board of directors.

If you’re not sure which nonprofit type is right for you, consider the following:

- To raise tax-deductible donations: 501(c)(3)

- To advocate or lobby: 501(c)(4)

- To serve members or an industry: 501(c)(5), 501(c)(6), or 501(c)(7)

- To operate a cooperative for farmers: 521(a)

- For primarily religious communal living with shared income: 501(d)

For missions or causes not covered by the main categories above, the list of special-purpose nonprofit categories outlined earlier is the best place to find the correct niche category.

Get your nonprofit off the ground with Givebutter

Understanding your nonprofit’s IRS classification helps you stay compliant, fundraise confidently, and make the most of the tax-exempt benefits available to your organization. While there are more than 30 nonprofit types, choosing the right one becomes much clearer once you understand how the IRS groups and evaluates them.

No matter which type of nonprofit you run, Givebutter is built to support you from day one. From public charities collecting tax-deductible donations to membership organizations managing dues or advocacy groups tracking supporters, Givebutter brings fundraising, donor data, and engagement tools together in one easy-to-use platform so you can focus on growing your impact, not juggling systems.

Explore the full range of free fundraising features

Sign up for Givebutter today and start fundraising with confidence.

FAQs about nonprofit categories

What are the most common types of nonprofits?

501(c)(3) organizations are the most common and widely recognized type of nonprofit organization, largely because they can receive tax-deductible donations. Nonprofits outside this category often focus on social welfare, advocacy, membership activities, or specialized operations.

How many different types of nonprofits are there?

There are more than 30 different nonprofit classifications recognized in the tax code. In practice, most tax‑exempt organizations you’ll encounter are 501(c)(3)s.

What’s the difference between 501(c)(3) vs. 501(d)?

A 501(c)(3) is a nonprofit organization that’s either a public charity or private foundation, where donations are tax-deductible.

A 501(d) is a nonprofit with a religious purpose or mission whose beneficiaries are members of the community, often operating a shared business.

What’s the difference between 509(a)(2) vs. 501(c)(3)?

501(c)(3) is the broader classification for charitable nonprofits. Within that category, organizations are further classified based on how they receive funding.

Organizations that rely on public donations, grants, or gifts are typically classified as 509(a)(1), while those that primarily generate revenue through memberships, ticket sales, or admission fees are classified as 509(a)(2).

What is a registered charity vs. a nonprofit?

The term “registered charity” is often used informally to describe an organization that raises funds for charitable purposes, such as ending world hunger or promoting animal welfare. “Nonprofit” is a broader category that includes charities, foundations, membership organizations, and other tax-exempt groups. All types of charities are nonprofits, but not all nonprofits are charities.

What are the 4 types of nonprofit organizations?

While there are more than 30 types of nonprofit organizations, the four types that are most commonly referenced are:

- Public charities (501(c)(3))

- Social welfare and advocacy organizations (501(c)(4))

- Business leagues and trade associations (501(c)(6))

- Social and recreational clubs (501(c)(7))

.svg)

%20(1).png)

.svg)

(3)_requirements_4x.webp)